Historically, on the Outer Banks when buyer exuberance for beach houses over inflates values, then is subsequently triggered by a fall in vacation rental revenues, the divide becomes too great for many to justify their carrying the investment.

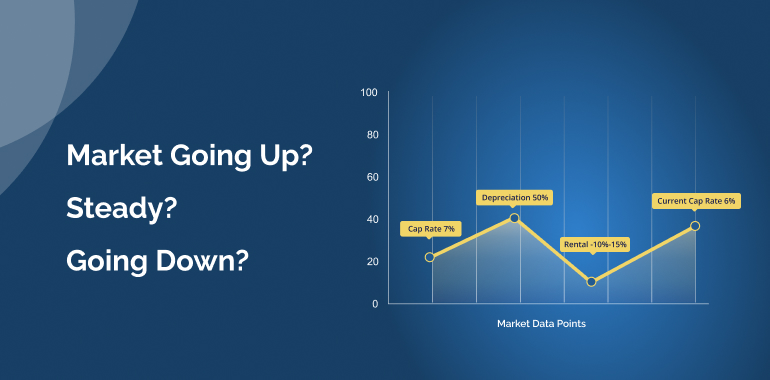

In the past, when increasing beach house values pushed down the vacation rentals’ gross cap rate percentage falling below 7%, it has consistently signaled a correction in property values within the following 2-3 years. Currently, recent sales reflect a gross revenue cap rate consistently around 6% or lower, leading many long-term investors to question the market’s trajectory. Previously when this occurred, Outer Banks vacation rental properties values have depreciated to where gross rental revenues are 10% – 15% of the property selling price. In 2010 that equation resulted in depreciations as much as 50%.

Currently verses 2010, there are different well publicized factors at hand. The underlying mortgage rates are drastically lower, and this round of 2nd home borrowers are much more financially stable, at least they were when they qualified to buy their beach house. So, the fall-off, if there is one, should not be as drastic. But the fact remains there are many ownersdealing with far less rental income than they were expecting. And when looking to reduce family costs often the beach house is the first to go.

On the upside, well-healed investors will ride out the cycle. And for certain there a many long-term Outer Banks investors waiting and ready to step back in. Owners that purchased prior to 2022 typically enjoy solid equity, while newer purchasers, even though values have continued to increase may find it challenging to sell profitably. Some property owners are exploring cash-out strategies while still planning to reinvest later in the Outer Banks market once the outlook becomes clearer.